Ad-Hoc Analysis

Ability to dump PowerBI report content into the users local copy of Excel + Analyse in Excel from PowerBI

Claims split by Risk

Claims transactions split by the actual risks associated with the product on each policy

Complaints Register

Register of all complaints, by type and matched to the relevant quote, policy or claim

Customisation

User defined hierarchies and bandings in the insurance cube + dynamic policy mapping

Standard Industry Rules

Industry based rules for validating premium and claims transactions

Customer Specific Validation Rules

Data validation rules specific to the customer

Missing Data Analysis

For all analysis dimensions, auto mapping of all missing items to a default member

KPIs

Standard set of documented measures and customer specific measures

Loss Ratios

Ultimate Loss Ratios - This requires the claims estimation models to be implemented. Enables the calculation of project loss ratios based on future claims estimations

Managed Data Sources

Fully automated source (XLSX or SQL) - Customer specific data source - either on premise or hosted by a 3rd party

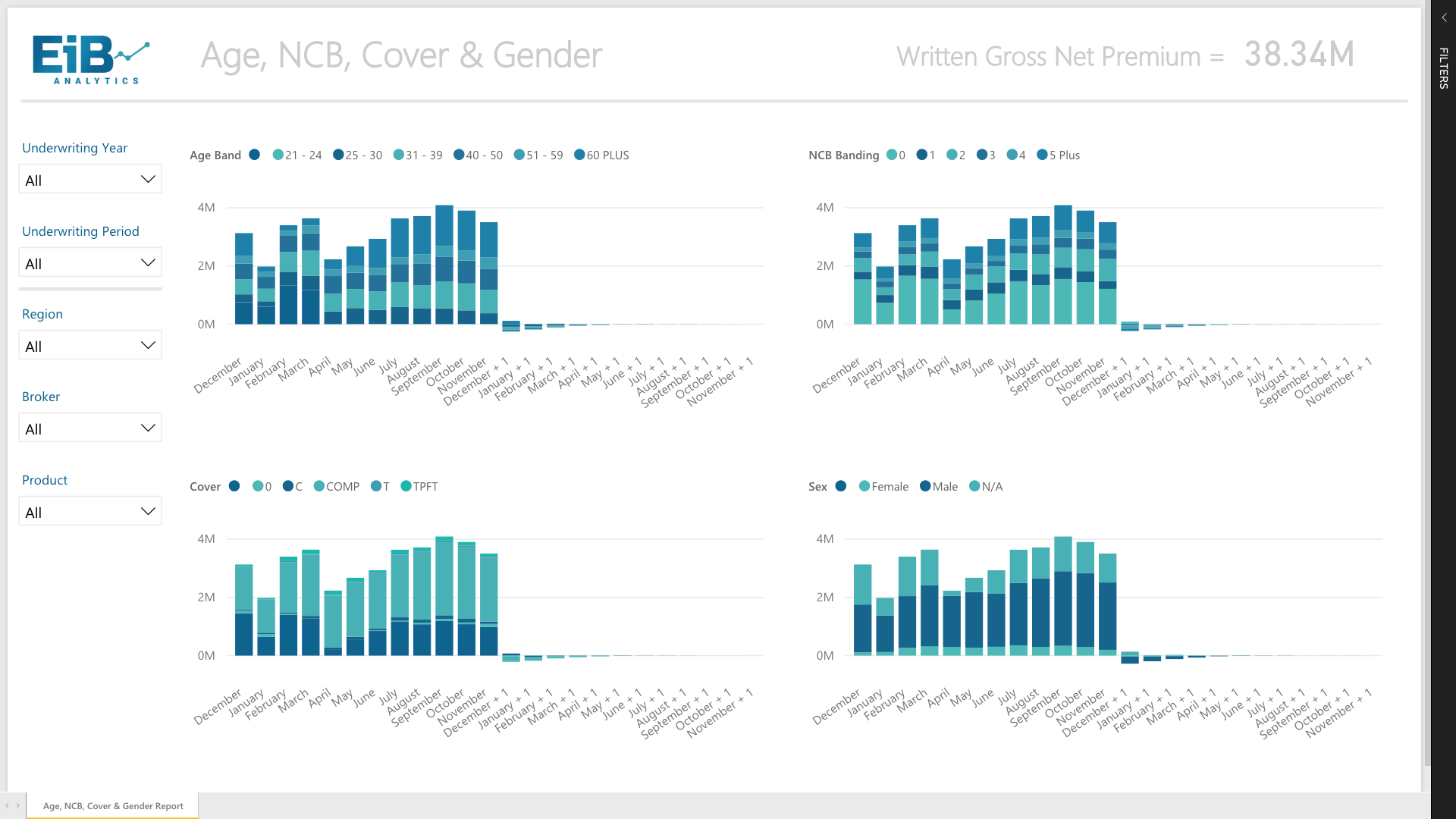

Standard Premium Analysis

Written and earned premium analysis across all defined policy and claims attributes

Policy Holder Analysis

Premium analysis across all policy holder details

Insured Analysis

Premium analysis across all insured attributes

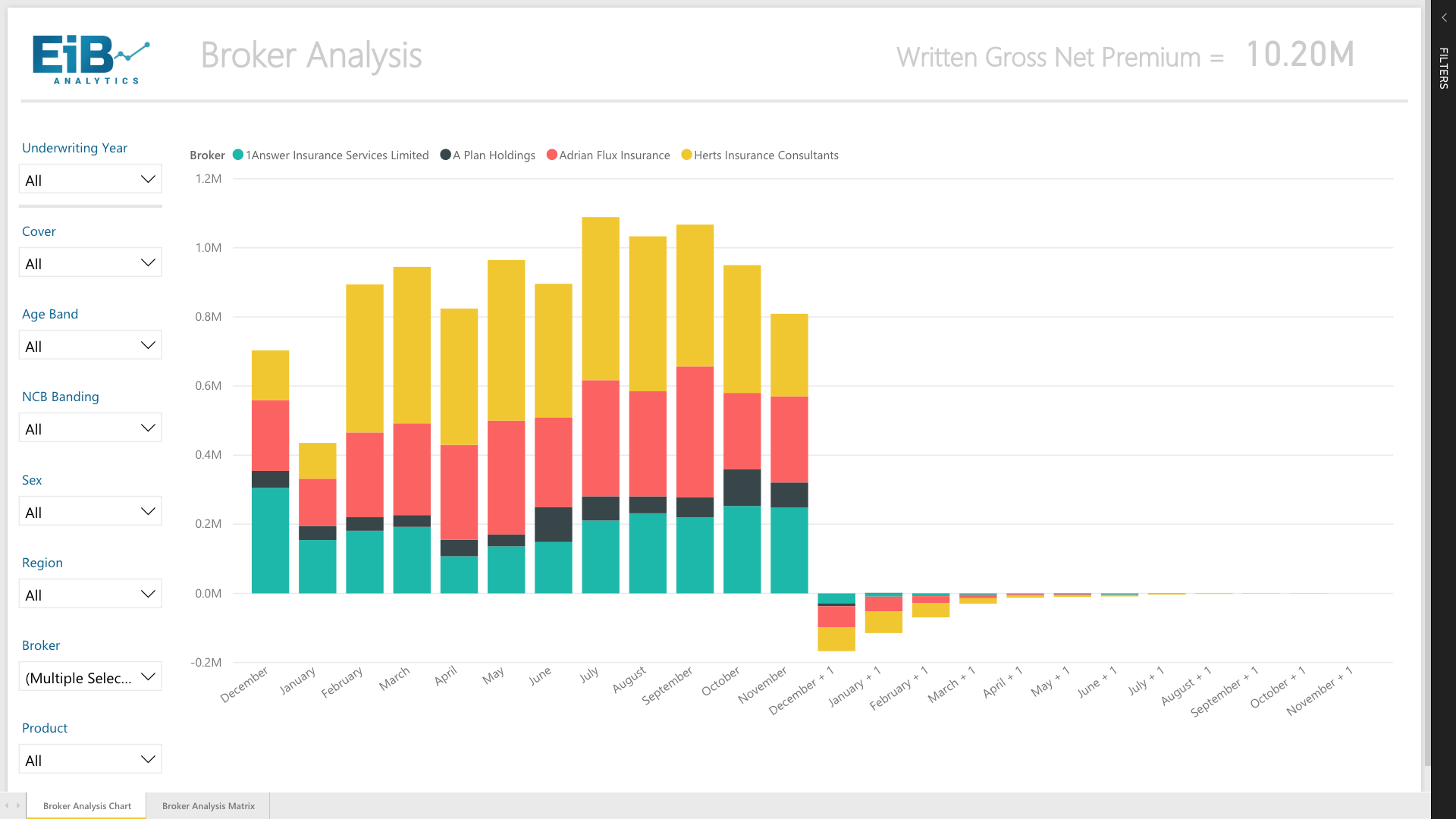

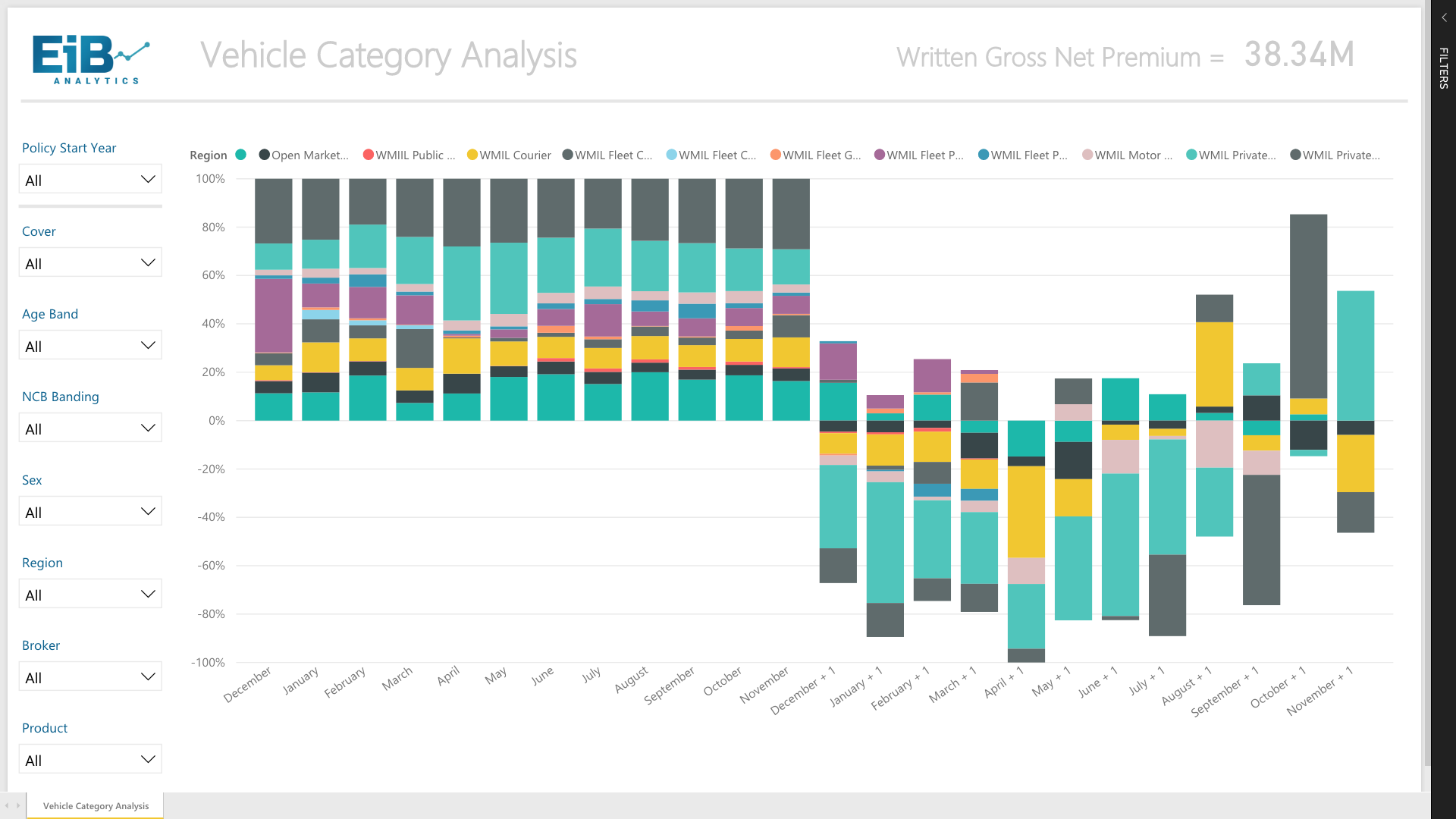

Product Analysis

Multiple LOB - Product specific attributes + Risk Analysis - Ability to define a risk register and link multiple risks to each product.

Standard Quotation Analysis

Quotation analysis by product, person and time

Quote Conversion Analysis

Analysis on quote to policy conversion

Sales Productivity Analysis

Quotation analysis by location, team and sales person (including conversion analysis)

Reports

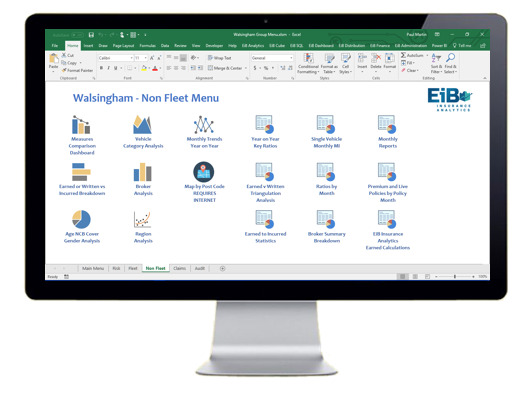

Standard set of PowerBI Dashboards / Reports / Excel Menus / Excel Reports

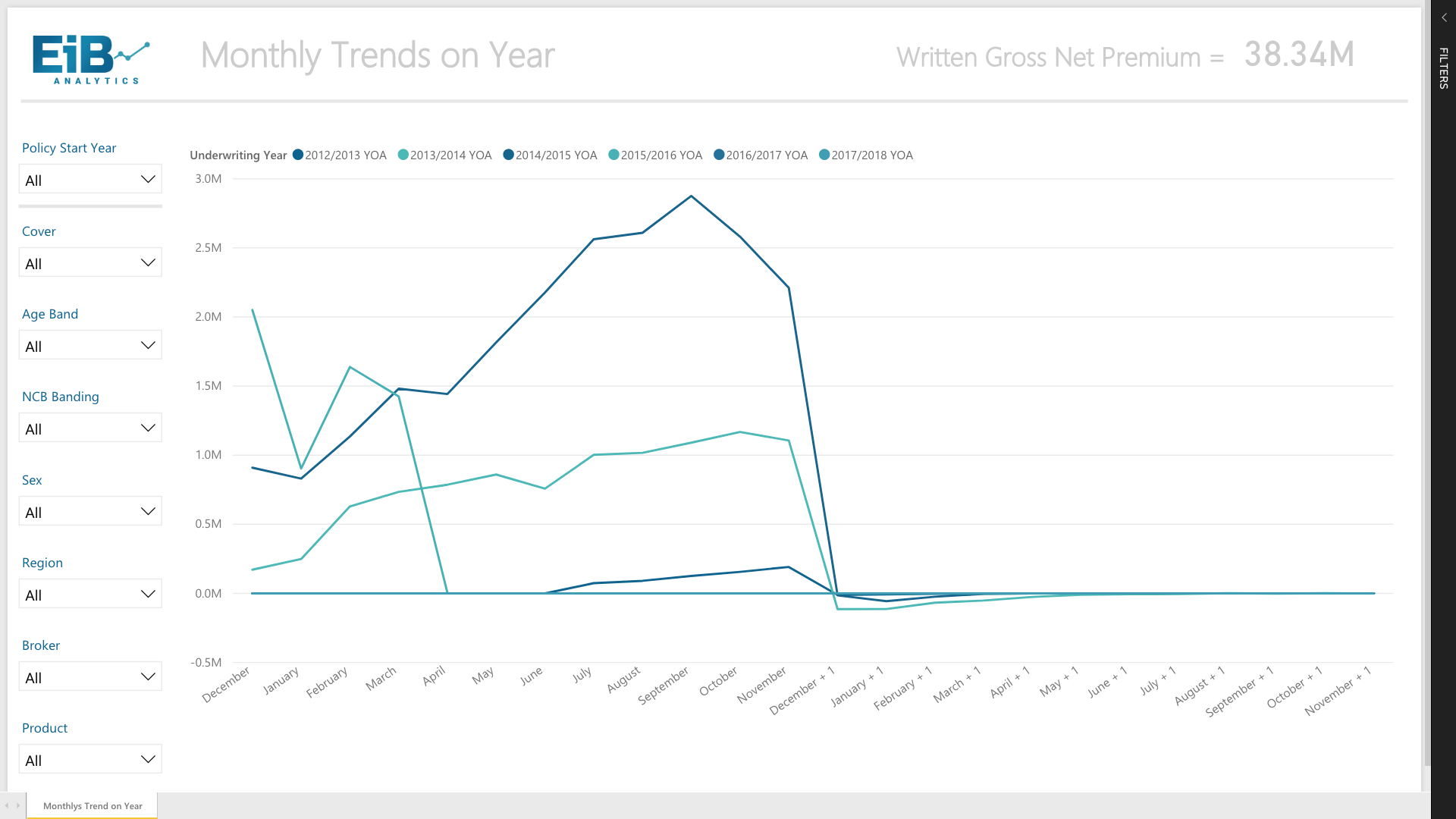

Time Intelligence

Ability to define a register of all binder agreements and analysis by underwriting periods based binder period associated with each policy

Statistical Analysis

Customer specific statistical measures

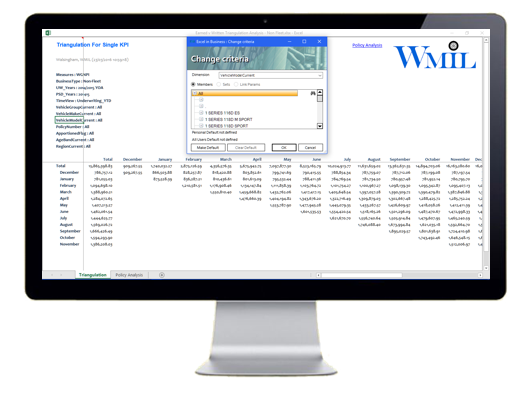

Triangulation Statistics

Advanced Triangulations - Multi year triangulation reports

Currency Analysis

Multi Currency Conversions (single reporting currency) + Multi Currency Conversions (multiple reporting currencies)

Exception Analysis

A standard set of exception based analysis rules. Aims to identify exceptions across attribute members + Customer specific exception rules

Financial Analysis

Cashflow Analysis - Ability to store all receipts, invoices and payments against policies

Geospatial Analysis

Vector Based Geo Analysis - Ability to analyse premiums and claims using maps

Predictive Analysis

Claims Estimation - A number of standard claims estimation models that enables use to estimate future claims against historical performance

Claims split by Claimant

Ability to analyse instances where a claimant claims against more than one risk in a single claim

2-4 Data Sources Supported

35 Days MI Consultancy

20 Monthly Support Hours