Core Business

Antilo UK Ltd was founded in 2014 and specialises in niche motor insurance, predominantly within the Taxi environment.

Reporting Background

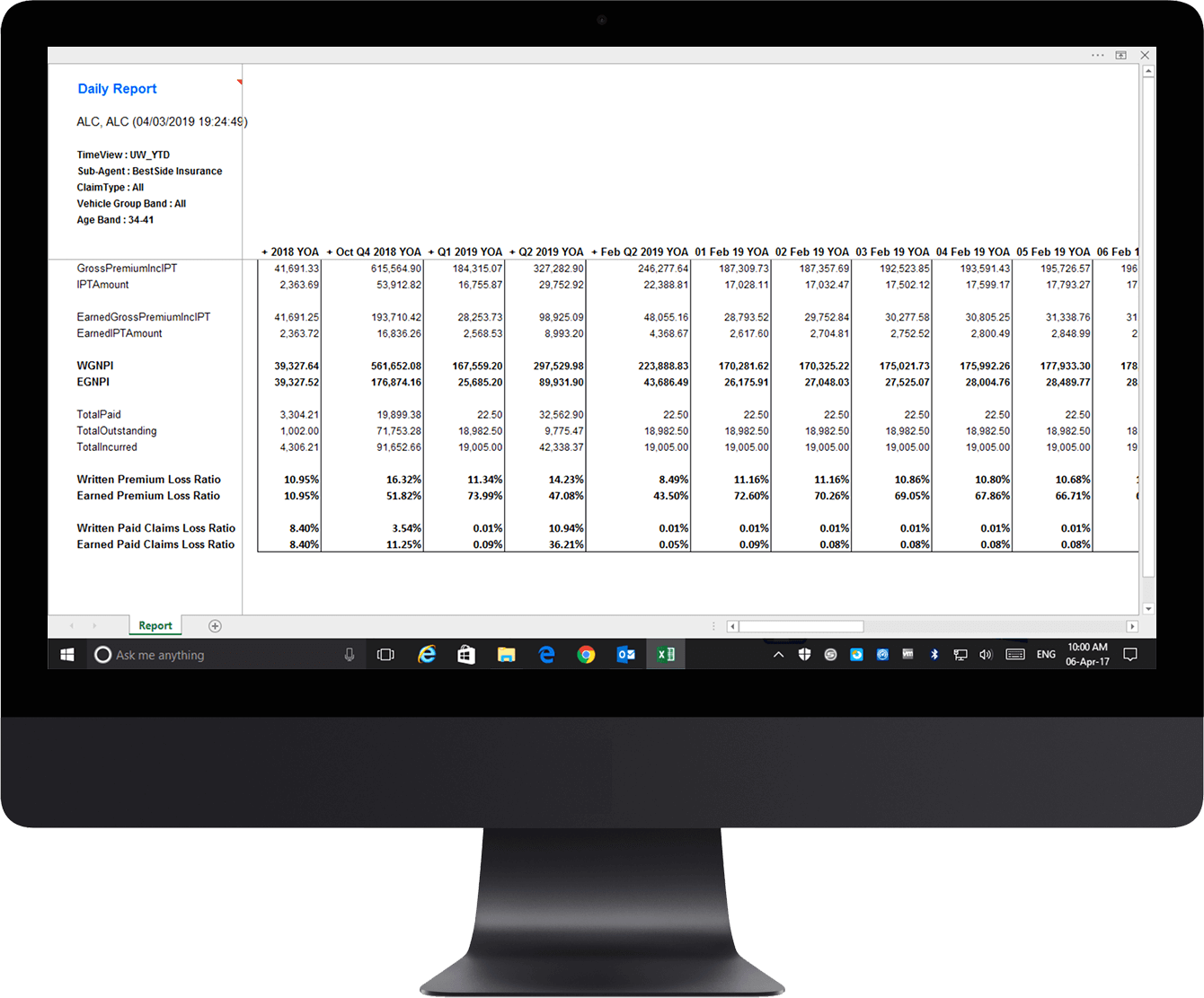

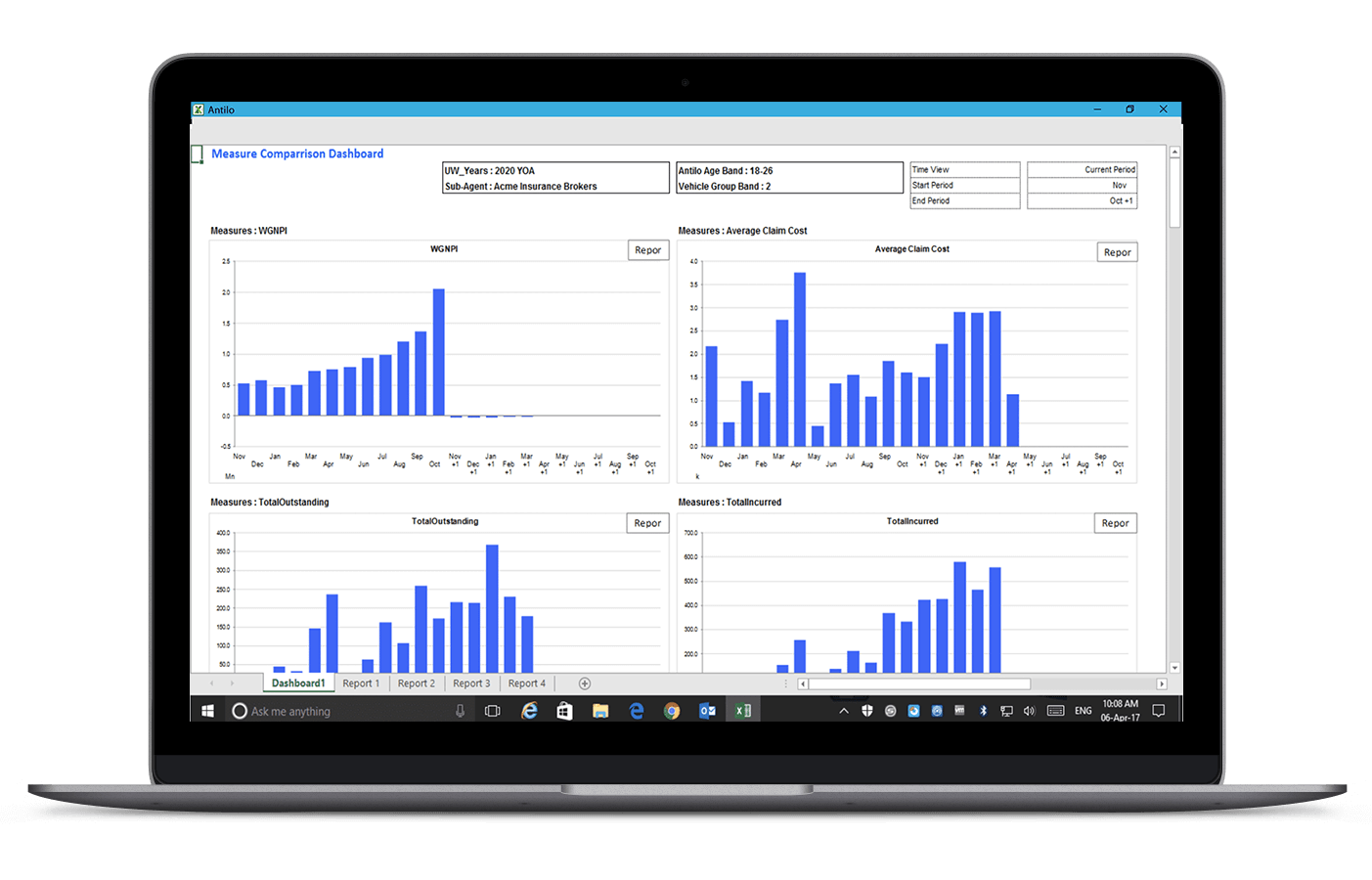

When Antilo first started delivering MI prior to EiB Insurance Analytics, both Premiums and Claims data feeds were manually downloaded into Excel Pivot Tables before being distributed to their management team and their carrier. This process happened on a monthly basis and was not only time consuming, it was also dependent on key staff to deliver. “Now that process is fully automated using EiB Insurance Analytics, everyone gets reliable information at a touch of a button” says Vivienne Gilroy, Principle Underwriter at Antilo.

“In addition, the scalability of EiB Insurance Analytics allows us to take a more granular approach to reporting and we can now deliver full daily based performance reports and analyses. This instils confidence in our results both internally and with our external carrier. We can drill down from year to quarter to month to days in seconds for any given underwriting year, or view trends across multiple years of account.”