Core Business

Walsingham Motor Insurance Limited (WMIL) is a Managed General Agent (MGA) operating within the commercial motor fleet sector.

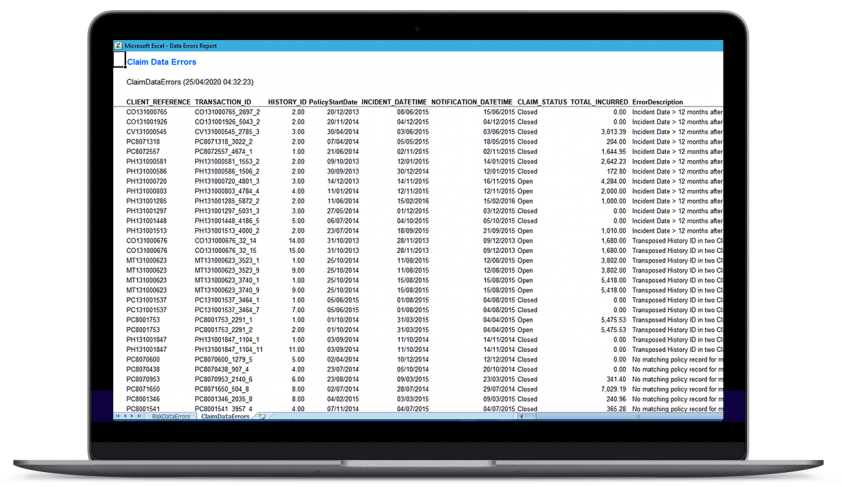

Reporting Background

Before EiB Insurance Analytics, both Premiums and Claims data feeds were manually downloaded into Excel by one of WMIL’s Underwriters to produce Management Information. This process was not only time consuming taking up to 5-6 days each and every month, it was also very difficult to provide information in various views which were required by the carrier to monitor WMIL’s business performance. Garry Watson, Managing Director, WMIL explains – “Management Information is key to everything we do, yet before EiB Insurance Analytics we couldn’t trust our results despite the immense manual effort and commitment from our team.

The use of EiB Insurance Analytics has saved us money, because with fully automated results, we now know what we’re writing, which helps us identify the potential for profitable business. This of course benefits both our Management Team and our carrier, who we now provide a better service to.”