BIBA always presents the perfect opportunity to engage with the full spectrum of stakeholders from across the insurance industry, and find out exactly what is happening in the MI space.

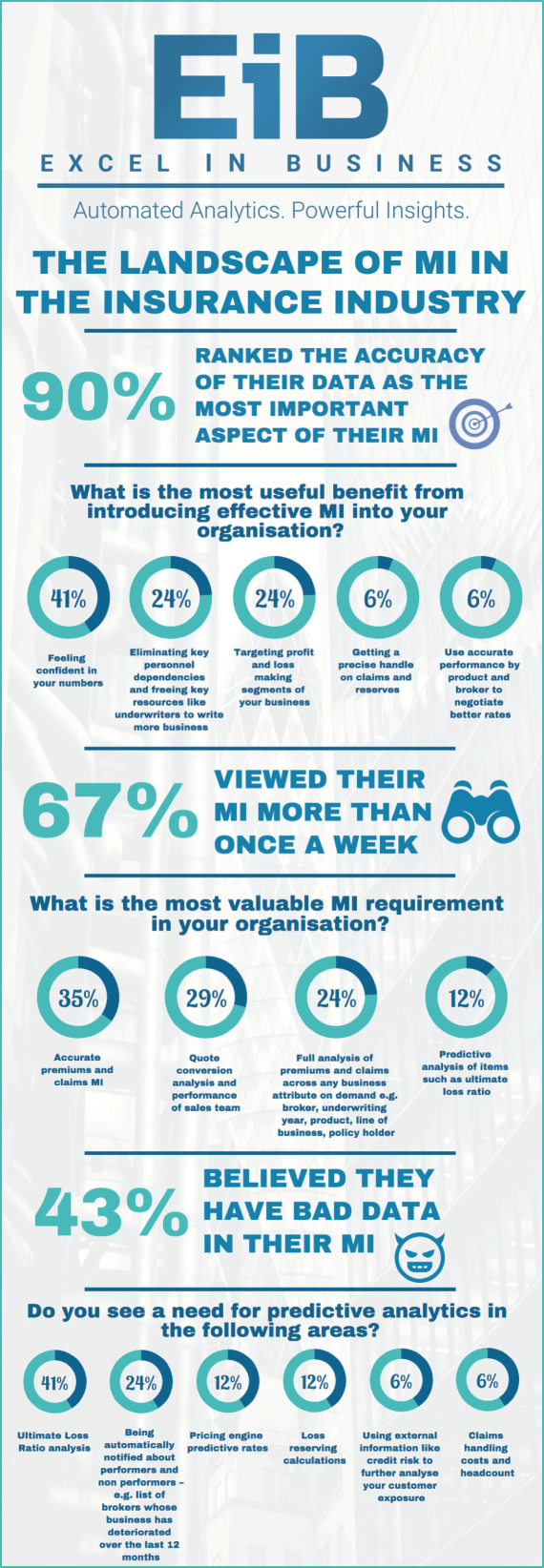

This year we conducted a survey of over 100 incumbents from brokers, underwriters, MGAs, InsurTech, insurers and reinsurers, and delved a little deeper into the MI behaviour of the sector to find out how the industry is adapting to such a significant digital transformation, as we enter an increasingly data-dominated environment.

Given this year’s ‘Innovate, Evolve, Thrive’ theme at BIBA being more tech-centric than ever before, and with the recent passing of GDPR legislation, it was almost impossible to avoid the topic of ‘data’ in conversation. Indeed, even the FCA’s Chief Financial Officer, Andrew Bailey, in his opening keynote alluded to Insurance by its very nature being a data-hungry business, with the assessment and pricing of risk depending on good data on the insured.

So it was quite alarming to see that there were still so many questions being asked about the integrity of data being used to produce MI in the industry. Contrastingly, although it came at no surprise , the majority of respondents said that feeling confident in their numbers was the most useful benefit of effective MI, which begs the question, why isn’t the issue of bad data addressed at source?!