Articles

Such professionals could be susceptible to federal income tax dependent on the submitting status or other income. 915, Societal Protection and Comparable Railroad Pensions, to learn more. An individual in the first place rejected advantages, but later on approved, can get found a swelling-contribution commission on the several months whenever pros was rejected (which are previous decades).

Have to create qualifying dollars choice which have probability of -200 otherwise higher. Should your very first being qualified wager settles since the a loss of profits, receive a non-withdrawable Bonus Choice comparable to their risk, as much as all in all, $500.Come across complete T&C at the BetRivers. Your own extra will likely be put into your account just after you help make your being qualified put.

List of Banking companies (within the alphabetical buy)

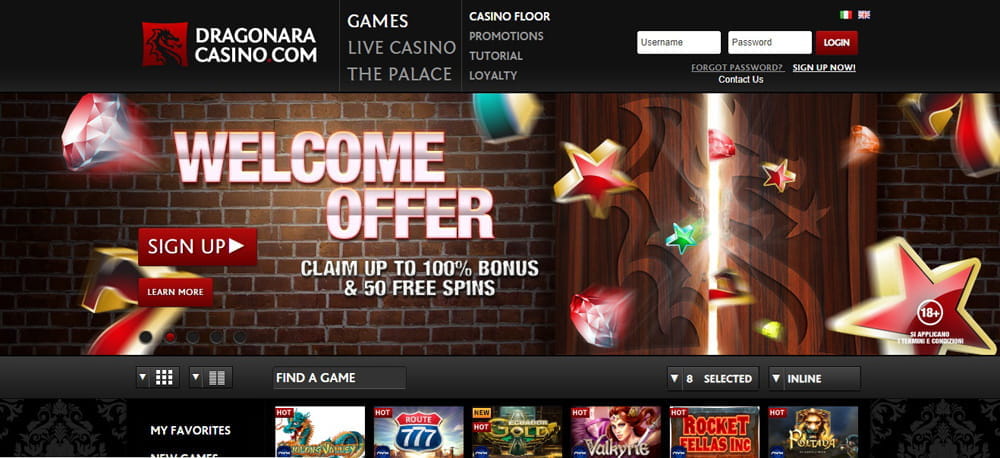

Playing at the $1 put casinos includes limited risk, you’ll nevertheless determine attractive advertisements and you can gambling establishment perks. You’ll will also get the chance to rating a be for the casino as opposed to risking an excessive amount of your own difficult-gained cash. You can view our better-ranked $step 1 deposit casinos right here in this post. Our large-rated $step one gambling enterprises are Twist Casino, Ruby Fortune, and you will JackpotCity Gambling enterprise. An educated gambling enterprises boast a big library from online casino games, level all types and you will templates.

Short-term absences on your part or the man to own special issues, for example school, trips, business, medical care, armed forces provider, or detention inside the an excellent teenager business, matter since the day the child this hyperlink lived with you. If it is determined that the mistake is actually on account of con, you will not be permitted to claim any of these credit for ten years. Learn how to desire the fresh disallowance period regarding the Guidelines to own Setting 8862, to learn more on what doing if you disagree with our very own commitment to’t claim the credit for two otherwise 10 years. The fresh Plan 8812 (Function 1040) and its instructions will be the unmarried source for calculating and you can reporting the little one tax borrowing from the bank, borrowing to many other dependents, and additional kid tax credit.

Even if you’re a leading roller to play during the higher limits or if you only want to installed a small amount rather than breaking the bank, we would like to make it easier to keep the profits. The initial step in order to minimizing your odds of having issues with this is to learn and you will understand the rules of one’s conditions you to surround these offers. Down below, we leave you a small bonus crash direction one to getaways the associated with the off to you. You could take-charge of your play when by the using their particular restrictions for your requirements. During the Hard rock Choice, you might limit the level of deposits and you will bets more an excellent put period of time. You can do the same with many go out your spend on the website.

Exemption to the fifty% Limitation to have Meals

Your taxable money are $60,100000 and also you weren’t entitled to one taxation credit. Your own standard deduction is actually $27,700, and you had itemized write-offs from $29,200. Inside the 2024, your acquired next recoveries for numbers subtracted on your own 2023 go back. Once you cash a bond, the bank and other payer you to redeems it will make you a form 1099-INT should your focus part of the percentage you can get is actually $ten or even more. Form 1099-INT, package step 3 is always to let you know the attention since the difference in the newest number your received as well as the matter paid for the bond.

No deposit Credit Bonuses

We used the new free processor chip and you may have been fortunate enough to cash-out $50 after fulfilling the fresh wagering specifications. We spent the money to experience 7 Stud Web based poker and you may Aces & Eights, two game having 97%+ come back rates. Let us take a closer look from the the required $100+ no deposit extra codes of 2025. These types of real cash casinos all the features huge lobbies full having plenty from online game along with the luxurious preference. Sportsbook deposit bonuses usually match your 1st deposit to the a good sportsbook as much as a certain amount. You may then use the matching extra finance to help you choice, so that as long because you match the turnover demands, you’ll be able in order to withdraw the brand new winnings out of your incentive while the real money.

- You may then found lots of totally free spins using one, or sometimes numerous, chose position(s).

- Less than these laws, you wear’t use in your revenue the new leasing property value a home (and tools) or a designated housing allocation offered to you included in your income.

- That you do not use in their gross income licensed withdrawals otherwise distributions which can be a profit of your own normal contributions from your Roth IRA(s).

- The laws and regulations to possess rollovers, said before under Rollover From one IRA To the Some other under Conventional IRAs, affect these rollovers.

- For many who receive playing winnings perhaps not susceptible to withholding, you might have to pay projected tax.

Or even play with a twelve months, their accounting period are a fiscal year. An everyday financial season try an excellent 12-day period one to comes to an end to your past day of one week but December. A week financial seasons varies from 52 in order to 53 months and you can always ends on the same day’s the fresh day. Your employer is required to render or publish Form W-2 to you no later than January 29, 2025.

Specific online sportsbooks also require large rollover, that can range from 2x in order to 25x. All of the money your win with your 30 free spins try additional for the added bonus balance once you finished the history spin. Along with your profits you can gamble all other game from the Playing Club Casino.

For this purpose, any improve so you can a cost carried out over the current year you to resulted in the deduction or credit is regarded as to possess quicker the tax in the earlier seasons. To help you claim an exception for expidited demise advantages made to your an excellent for each diem or any other occasional base, you ought to document Mode 8853, Archer MSAs and you will A lot of time-Term Care Insurance policies Agreements, with your go back. You wear’t must file Mode 8853 in order to exclude accelerated death professionals paid based on genuine expenses incurred. When the passing pros try paid off for your requirements in the a lump sum payment and other than from the normal intervals, include in your revenue only the pros that will be more the total amount payable for your requirements during the time of the fresh covered individuals death. If the benefit payable in the death isn’t specified, you include in your revenue the bonus payments that are much more versus present property value the new repayments during the time of demise.