The last instalment in our EiB Insights series, explored how our EiB Insurance Analytics solution allows you to access your raw premiums and claims bordereau and automatically transform this into powerful MI, without the arduous task of manually handling your data. Our focus now turns to the pertinent topic of what happens when your raw data is in fact erroneous data. After all, if the base data is flawed, then regardless of how thorough your analysis is, your MI will always yield inaccuracies and lack the necessary integrity to effectively monitor and evaluate your business performance.

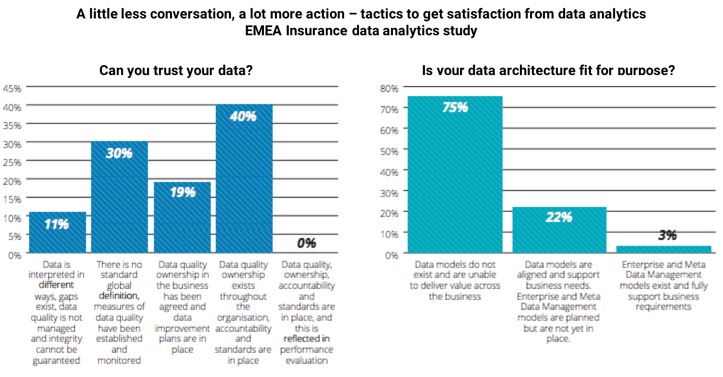

A PwC survey in 2015 showed 93 per cent of insurance CEOs regarded data analysis as the most strategically important digital technology for their business. But despite an obvious appreciation for how important data analysis is for organisations within the insurance industry, research also indicates that a predominance of their analysis is being founded-on erroneous data. A 2017 EMEA Insurance data analytics study, commissioned by Deloitte, discovered that only 40% of respondents found their data quality to be sufficient for trusted insights to be generated, and for an equal proportion, their data was undefined and of very poor quality.

So you can bet your bottom dollar that almost every organisation has, is or will fall victim to bad data. But rather than questioning whether your data is right or wrong, the important question to pose yourself, is do you have the necessary technological architecture to detect, address and fix your erroneous data, so that you can have complete peace of mind that your MI is in fact accurate enough to influence your business decisions. After all, without data that is consistent, accurate and reliable across the business, an organisation is destined to become less competitive and less efficient.

Unfortunately it seems that this is also not the case, with Deloitte’s EMEA Insurance data analytics study also reporting that with 75% of data models either not in existence or unable to deliver business wide value, data architectures in the insurance industry are not at the level that they need to be to fully maximise the power of analytics.

This real world issue has inspired the third instalment of our EiB Insights series, where we provide several live examples of how our EiB Insurance Analytics solution has been developed to automate the validation, rejection and auditing of all invalid risk and claims information, guaranteeing improved quality and self-healing MI.